- LaLiga was the only of Europe’s five major leagues to post a profit for 2019/20, the most recent season with audited results.

- There are several reasons for the strong results, such as LaLiga’s economic control and excellent relationships with broadcast partners.

Despite the significant disruption of the coronavirus pandemic to the sports industry, LaLiga’s financial results remain positive. For the 2019/20 season, LaLiga Santander and LaLiga SmartBank clubs saw a record total income of €5.045bn, up by 3.6% compared to 2018/19.

While estimates suggest that income without the pandemic would have reached €5.321bn, there was still a net profit of €77m, making LaLiga the only one of Europe’s five major competitions to turn a profit during this difficult season.

Key to these results is the economic control that has been in place since 2013 in LaLiga. This mechanism ensures that clubs spend only what they earn, with calculations made in advance of (rather than after) transfer spending.

“Our economic control rules are approved and accepted by the clubs themselves,” explained LaLiga President Javier Tebas. “The rules require clubs to cut costs when income shrinks and all clubs comply, because they trust the process. They take immediate steps to reduce costs and the numbers from 2019/20 show this. The figures are spectacular when compared to other competitions where there aren’t the same economic control rules.”

Highest per capita income across Europe

In contrast to LaLiga’s results, the top two divisions in each of Germany, France, Italy and England posted net losses in 2019/20. In the Bundesliga 1 and 2, the losses were €213m. Across Ligue 1 and Ligue 2 they were €500m. In Serie A and B, the deficit was €757m. While in the Premier League and Championship, the losses were €1bn.

These returns are even more noteworthy when considering that Spain has smallest population of these five countries. At €107 per capita LaLiga continues to be the leader in income in relative terms, considering the size of each local economy. The per capita figures for the other major leagues are €86 for England, €52 for Italy, €46 for Germany and €34 for France.

“Clubs are achieving huge optimisation with their income considering we’re the country with the smallest population of the five major leagues by quite a long way,” Tebas added. “Our clubs can still achieve levels of income from player sales that are almost at the level of the Premier League.”

Managing transfer and wage spend

Unlike in other leagues, LaLiga economic control imposes spending limits before transfer activity begins, meaning Spanish clubs made responsible adjustments in spending in response to the coronavirus crisis. LaLiga teams were particularly prudent the last two transfer windows as they brought in €496m and spent €458m, for a net gain of €38m. Meanwhile, in England there was a net loss in the transfer market of -€624m, -€92m in Italy, -€26m in Germany and -€22m in France.

The players of LaLiga have also made sacrifices, with most squad members and coaches accepting wage cuts or contract restructures. As a result, wage costs for 2019/20 were €78m lower than what would have been expected in the absence of COVID-19, according to PricewaterhouseCoopers’ estimations. Salary decreases are set to be even larger for 2020/21, the first full season under pandemic restrictions.

“There has been enormous effort from the LaLiga clubs as they faced this crisis, managing their finances responsibly to have a positive result despite all that happened,” added LaLiga corporate general director José Guerra. “The reduction in salary spending makes clear the responsibility of clubs and players, as they faced a crisis situation by being looking to help protect the viability of their clubs and the competition.”

Protecting broadcast income

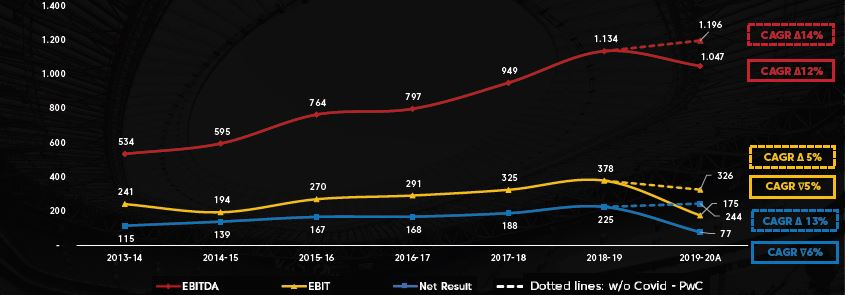

In addition to economic control, LaLiga broadcast incomes have provided a boost to Spanish clubs in recent years. The average cumulative long-term growth in LaLiga in each of the last five seasons was 12%, giving clubs significant economic solvency. This is, in part, a result of the centralised sale of TV rights that was introduced in 2015.

While the 2019/20 season affected broadcast incomes across the entire industry, the negative impact in LaLiga was just €42m. As Guerra explained, this is largely thanks to the way LaLiga has maintained and looked after relationships with broadcast partners over the years.

“The loss was less than 5% in our competition,” he said. “To put that into context, in Italy, Germany and England there were reductions between 12% and 15% in their income from TV. In France, where they suspended their competition, it fell 30%. The fact that LaLiga was able to have this reduced impact is thanks to the quality of the competition and the interest generated. We treat our broadcasters not as clients, but as partners. We have a common product to look after and we work together so that the impact for them and us is as small as possible. This is reflected in the numbers.”

Approaching the future with confidence

The effects of the pandemic will continue to be felt across all industries in the next few years, but with its system of economic control in place, LaLiga can approach coming seasons with confidence.

As reflected in the 2019/20 report, LaLiga maintains a good capacity for investment with a sustainable level of debt (NFD/EBITDA of 1.63x) and high profitability levels.

This means that the competition maintains the confidence of investors that allows them to obtain financing under favourable terms, thanks to their proven efforts in containing costs.

Tebas concluded that although financial losses are expected in all leagues for the current 2020/21 season, this will help ensure that LaLiga remains in the healthiest situation possible.

“When we present losses, LaLiga’s will be infinitely smaller than those of the others,” he said.